The world of finance is constantly evolving, and in recent years, investors have increasingly sought new avenues to grow their wealth. One such avenue is the realm of self-directed investing, where individuals have the power to manage their investment portfolios according to their unique goals and preferences. Among the companies facilitating this shift is the New Direction Trust Company, a leading provider of self-directed retirement accounts. With a mission to empower investors, New Direction Trust Company offers a suite of services that enables clients to diversify their portfolios beyond traditional stocks and bonds.

Through self-directed accounts, clients can invest in a wide variety of assets, including real estate, precious metals, private equity, and more. This flexibility not only allows investors to take control of their financial futures but also provides opportunities to capitalize on emerging markets and unique investment strategies. As the demand for alternative investments grows, companies like New Direction Trust Company are at the forefront, helping clients navigate the complexities of self-directed investing.

In this article, we will delve deeper into the New Direction Trust Company, exploring its services, benefits, and how it can serve as a catalyst for your investment success. Whether you are a seasoned investor or just starting out, understanding what New Direction Trust Company has to offer can help you make informed decisions about your financial journey.

What Services Does New Direction Trust Company Offer?

New Direction Trust Company provides a comprehensive suite of services aimed at empowering investors to take control of their financial futures. These services include:

- Self-directed IRAs (SDIRAs)

- Solo 401(k) plans

- Health Savings Accounts (HSAs)

- Education Savings Accounts (ESAs)

- Custodial services for alternative assets

How Does New Direction Trust Company Facilitate Self-Directed Investing?

Self-directed investing can be a complex process, but New Direction Trust Company simplifies it for clients. Here’s how:

- Account Setup: Clients can easily set up their accounts online, allowing for quick access to investment opportunities.

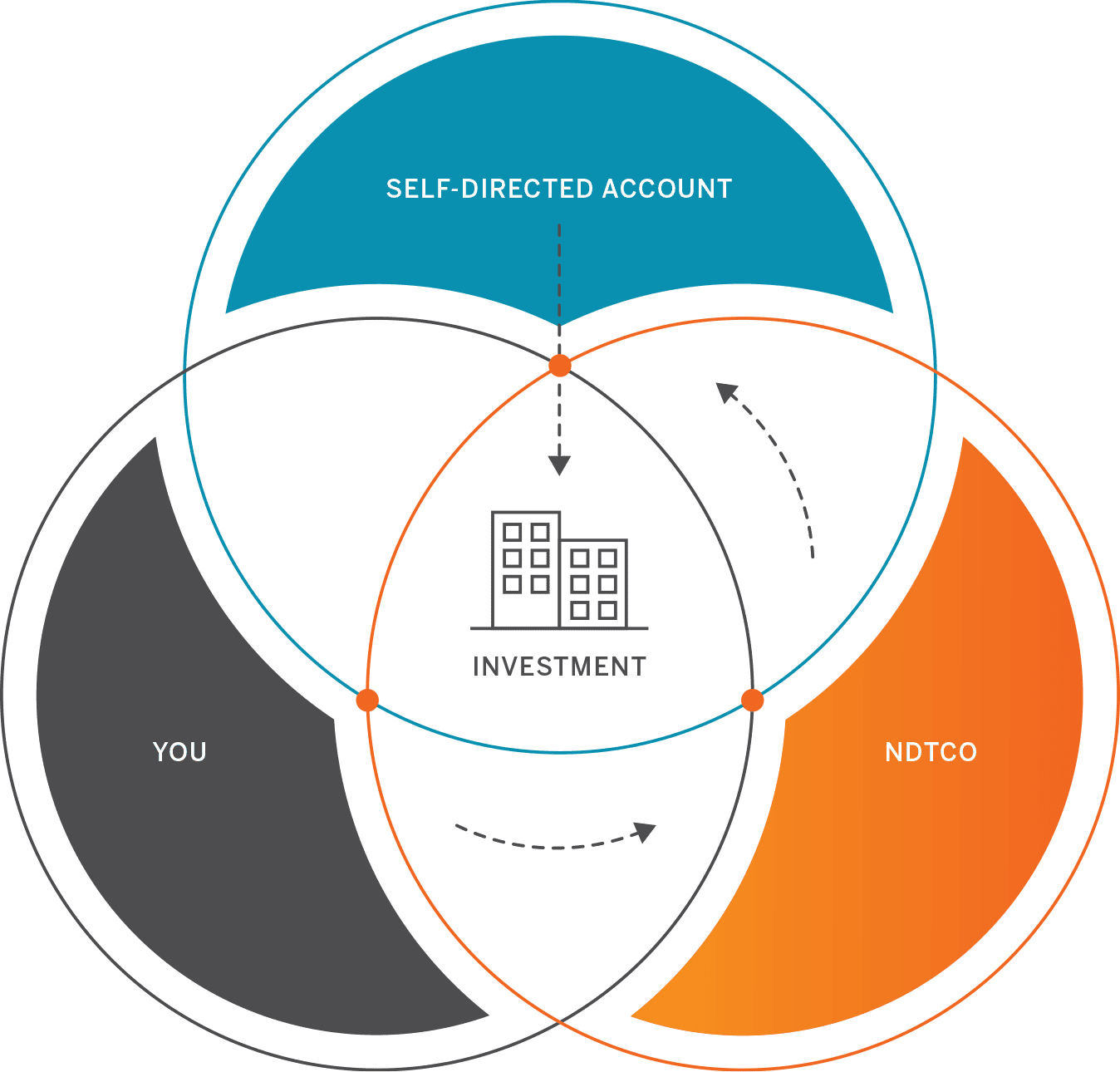

- Asset Custodianship: New Direction Trust Company acts as a custodian for alternative assets, ensuring compliance with IRS regulations.

- Education and Support: The company provides educational resources and support to help investors make informed decisions.

What Are the Benefits of Using New Direction Trust Company?

Investors who choose New Direction Trust Company can enjoy numerous benefits, including:

- Diversification: Access to a wide array of investment options beyond traditional stocks and bonds.

- Control: Clients have full control over their investment decisions and strategies.

- Tax Advantages: Self-directed accounts often come with tax benefits, depending on the type of account.

What Types of Investments Can You Make with New Direction Trust Company?

New Direction Trust Company allows clients to invest in a diverse range of alternative assets, including:

- Real estate

- Precious metals

- Private placements

- Cryptocurrencies

- Tax liens

How Does New Direction Trust Company Ensure Security and Compliance?

Security and compliance are paramount in the world of self-directed investing. New Direction Trust Company implements various measures to safeguard client investments:

- Regular audits to ensure compliance with IRS regulations.

- Robust cybersecurity measures to protect sensitive data.

- Transparent fee structures to ensure clients understand their costs.

What Do Clients Say About New Direction Trust Company?

Client testimonials provide insight into the reputation and reliability of New Direction Trust Company. Many clients praise the company for its:

- Exceptional customer service

- Ease of account management

- Comprehensive educational resources

How Can You Get Started with New Direction Trust Company?

Getting started with New Direction Trust Company is a straightforward process. Here’s a step-by-step guide:

- Visit their website: Start by exploring the New Direction Trust Company website for information on available accounts and services.

- Create an account: Follow the prompts to set up your self-directed account.

- Fund your account: Transfer funds from an existing retirement account or contribute new funds.

- Start investing: Use your account to explore and invest in alternative assets.

Conclusion: Is New Direction Trust Company Right for You?

In conclusion, New Direction Trust Company stands out as a leader in the realm of self-directed investing, offering investors the tools and resources they need to diversify their portfolios and take control of their financial futures. With its comprehensive suite of services, commitment to education, and focus on compliance and security, New Direction Trust Company is well-equipped to help clients navigate the complexities of alternative investments.

If you are looking to explore new avenues for wealth creation, consider the opportunities presented by New Direction Trust Company. With their guidance, you can embark on a journey toward financial independence and investment success.